Crisis Support

Life can change in an instant. Whether a loved one is facing sudden long-term care needs, forced hospital discharge, or a Medicaid crisis, Elder Advisers® can step in quickly to help you navigate next steps.

Timely Action

Timing matters when it comes to elder care and asset protection. Delays can limit your options, but taking action now can open doors to better care, more financial security, and greater peace of mind.

Proactive Planning

You don’t have to wait for a crisis to get started. Proactive planning puts you in control, helping you preserve your family’s assets, avoid unnecessary costs, and prepare for future care needs

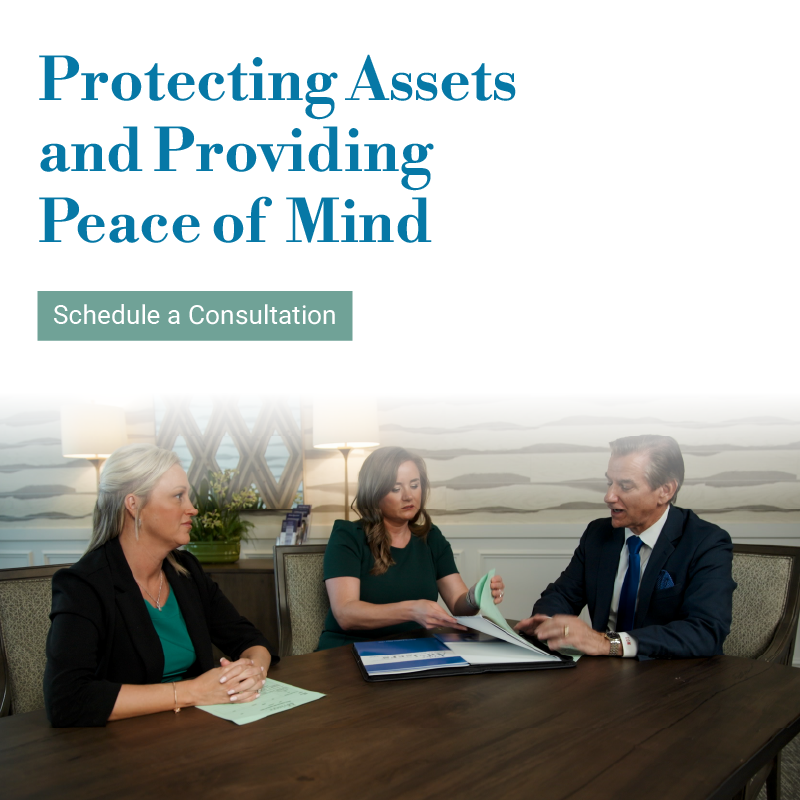

Shield your hard-earned assets from

long-term care expenses

Shield your hard-earned assets from long-term care expenses

Our mission is simple

For nearly three decades, Elder Advisers® has helped families in Kentucky and Indiana navigate the complexities of aging, long-term care, estate planning and Medicaid planning. Whether you are planning ahead, facing a sudden health crisis, or already managing care, our team brings clarity, compassion, and proven strategies to protect what matters most, your loved ones and their legacy.

Planning today is the greatest gift you can give your parents tomorrow.

Secure Your Future by Putting These Essentials into Place

* Elder Advisers® does not provide legal counsel. We can work with your attorneys or refer you to trusted legal professionals who can help you navigate your specific needs.

Senior Healthcare Professionals

Senior Healthcare Professionals

Supporting Your Clients, Easing Your Workload

If you are a healthcare or senior care provider, we help your clients access benefits quickly and efficiently. We understand how challenging your work can be, and we’re here to assist families with banking, Qualified Income Trusts, level of care changes, VA benefits, life insurance, and more. We value your referrals and look forward to partnering with you to provide the best care possible.

Elder Advisers® has helped hundreds of families successfully protect their assets. Here are key areas where we personally guide and support you.

Elder Advisers has helped hundreds of families successfully protect their assets. Here are key areas where we personally guide and support you.

* Elder Advisers® does not provide legal counsel. We can work with your attorneys or refer you to trusted legal professionals who can help you navigate your specific needs.

* Elder Advisers does not provide legal counsel. We can work with your attorneys or refer you to trusted legal professionals who can help you navigate your specific needs.

Medicaid Planning & Applications

- Asset protection strategies for single people and couples

- Handling state interviews, filings, and appeals

- Guidance with over-resourced clients and complex eligibility issues

Estate & Legacy Planning

We work with you and trusted legal counsel to:

- Secure your home and savings before a crisis

- Plan ahead with the 5-year look-back period

- Protect family wealth for future generations

Irrevocable Funeral Trusts

- Irrevocable Funeral Trusts

- Medicaid-exempt up to $20,000

- Growth inside the trust, not counted as an asset

- Flexible and portable with any funeral home

- Provides peace of mind for families and relief from unexpected costs

Personal Care Coordinator

- Patient advocacy and caregiver relief

- Coordinating with hospitals, rehab, and senior living facilities

- Attending care plan meetings on behalf of families

- Helping set realistic expectations for ongoing care

Crisis & Pre-Srisis Support

- Immediate help when care needs change suddenly

- Support for adult children making difficult decisions

- Bridge planning for those in assisted living, rehab, or skilled care

Personal Care Coordinator

- Patient advocacy and caregiver relief

- Coordinating with hospitals, rehab, and senior living facilities

- Attending care plan meetings on behalf of families

- Helping set realistic expectations for ongoing care

Crisis & Pre-Srisis Support

- Immediate help when care needs change suddenly

- Support for adult children making difficult decisions

- Bridge planning for those in assisted living, rehab, or skilled care

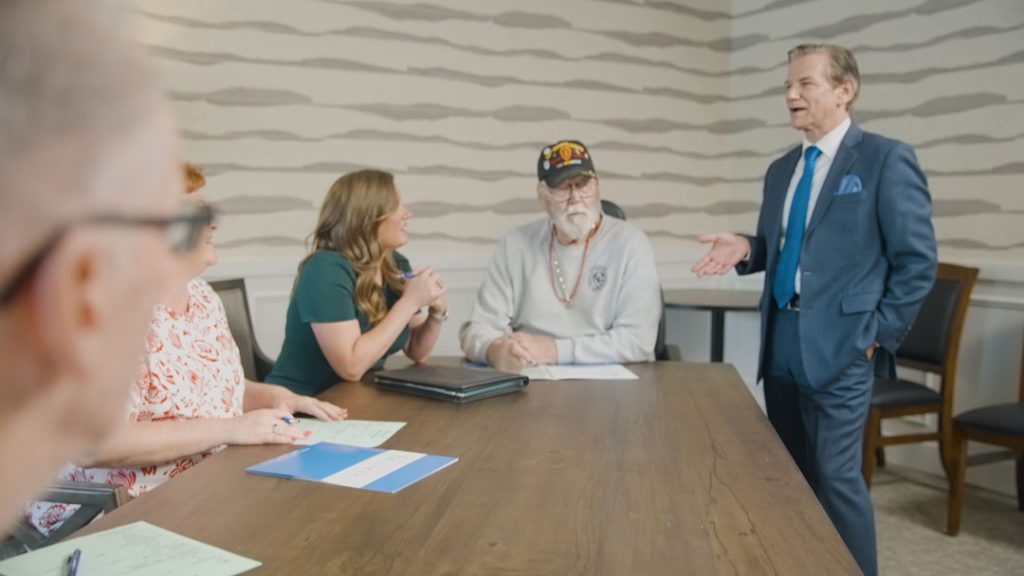

Meet the Team

Our experienced team is ready to assist you with protecting your assets and planning your legacy.

Larry Weiss

President

Lindsey Fleming

Senior Vice President

Autumn Schneider

Director of Client Services

Kelli Albrechht

Director of Case Management

Mya Coddington

Case Manager

Megan Randall

Case Manager

Ashley Evans

Case Manager

Abbi Harrison

Assistant Case Manager

Timothy Goebel

Director of Documentation

Marianne Keller, MSSW

Personal Care Coordinator

Suzanne Burton

Community LiaisonTough times....glad I was able to point you in the right direction. lw

Most important she explained our options for mom's care plan in a clear understandable way.

Medicaid expects you to pay once you have been forced to seek long term assisted living. I received approx 15 requests and denials from FSSA . Elder Advisors answered every inquiry with little or no effort on my part. Medicaid demands a tremendous amount of accounting. Again Elder Advisors provided the documentation necessary to support my claim. They also contacted me by phone to give me updates. Staff is friendly and responsive. My process ,start to finish , was 9 months. I am satisfied that Elder Advisors fought for me . I saved about half the money that I calculated for Medicaid penalties. About $50k.

Thank you Larry Weiss

if you need to put a loved one in a nursing home be sure to contact them first

On a more serious note Lisa this is Tough Stuff! It's always gonna be tough...but we can help soften the landings for families! Larry

Life span vs. Health span

Life span vs. Health span

Your life span is how long you live; your health span is how long you live well. The later years—when health challenges often arise—can also be the most expensive, from medical bills to long-term care. Planning ahead helps ease these costs, protect your savings, and let you focus on living comfortably, not worrying about expenses.

Schedule a Consultation Today!

(800) 763-7930

(800) 763-7930

Contact Us

Please provide the following information and a team member will be back with you soon.

"*" indicates required fields

Let us help you better prepare for your future

We provide prompt, easy-to-understand guidance and schedule appointments that fit your busy life. It never costs anything to sit with us and learn how we can help you and your family. Call today to book your free discovery meeting.